The Ultimate Occupation Course for Independent Adjusters in the Insurance Policy Industry

Browsing the elaborate web of possibilities within the insurance policy sector can be a complicated yet rewarding journey for independent adjusters seeking to carve out a successful job course. From refining vital abilities to seeking innovative accreditations, the best profession trajectory for independent insurance adjusters is a multifaceted surface that demands strategic planning and continual growth.

Comprehending the Insurance Coverage Sector Landscape

Understanding the insurance policy market landscape is essential for independent insurers to navigate the intricacies of this field effectively and properly. The insurance sector is a dynamic and substantial industry that incorporates various sorts of insurance coverage, including residential or commercial property, life, wellness, and casualty insurance policy - independent adjuster firms. Independent adjusters should have a detailed understanding of the various kinds of insurance coverage, insurance coverage limitations, laws, and market trends to stand out in their roles. By staying informed regarding industry growths, such as emerging innovations, regulative changes, and market demands, independent insurers can much better serve their customers and make informed choices throughout the insurance claims modification procedure.

Additionally, a deep understanding of the insurance industry landscape makes it possible for independent adjusters to build solid partnerships with insurer, policyholders, and other stakeholders. By having a solid grasp of just how the sector operates, independent insurance adjusters can successfully work out settlements, resolve conflicts, and advocate for reasonable case end results. Overall, an extensive understanding of the insurance policy sector landscape is a foundational element for success in the field of independent adjusting.

Developing Essential Skills and Know-how

Moreover, a strong grip of insurance coverage regulations and plans is vital. Insurers should stay current with industry legislations, standards, and criteria to make sure compliance and provide exact guidance to clients - independent adjuster firms. Additionally, analytical abilities are vital for independent insurers that frequently come across tough scenarios that call for fast reasoning and cutting-edge remedies to meet customer needs

Continuous knowing and specialist growth are vital to remaining affordable in this area. By sharpening these essential skills and experience, independent insurers can develop successful occupations in the insurance policy field.

Building a Solid Specialist Network

Establishing durable connections within the insurance sector is important for independent insurers looking to progress their occupations and increase their possibilities. Building connections with insurance providers, asserts supervisors, fellow insurance adjusters, and various other market specialists can open doors to new projects, mentorship possibilities, and possible recommendations.

Furthermore, networking can additionally lead to partnerships and cooperations with other specialists in related navigate to this website fields such as insurance policy lawyers, agents, and professionals, which can additionally improve an insurer's capacity to supply efficient and detailed cases solutions. By proactively buying structure and keeping a solid expert network, independent insurers can position themselves for lasting success and development in the insurance policy field.

Advancing to Specialized Adjuster Roles

Transitioning to specialized insurer roles needs a deep understanding of niche areas within the insurance coverage field and a dedication to continual discovering and expert development. Specialized insurer roles supply chances to focus on specific sorts of insurance claims, such as property damages, bodily injury, or employees' settlement (independent adjuster firms). These functions demand a higher degree of expertise and often need added accreditations or specialized training

To progress to specialized insurance adjuster placements, individuals should take into consideration pursuing industry-specific qualifications like the Chartered Building Casualty Underwriter (CPCU) or the Partner in Claims (AIC) classification. These certifications demonstrate a commitment to understanding the complexities of a particular location within the insurance field.

Moreover, getting experience in expanding and managing complex claims expertise of relevant laws and guidelines can boost the chances of transitioning to specialized duties. Building a strong professional network and looking for mentorship from skilled adjusters in the desired specific niche can additionally offer useful understandings and open doors to improvement possibilities in specialized adjuster positions. By continually refining their abilities and remaining abreast of sector fads, independent adjusters can place themselves for an effective job in specialized functions within the insurance policy field.

Achieving Expert Certifications and Accreditations

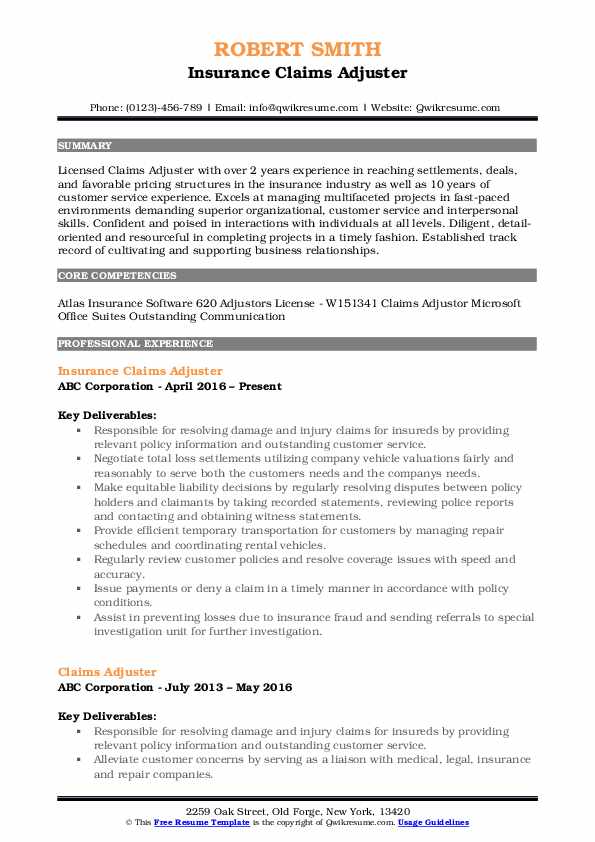

Making expert accreditations and accreditations in the insurance industry symbolizes a commitment to specific proficiency and continuous expert advancement past typical adjuster functions. These credentials validate an adjuster's knowledge and abilities, establishing them apart in an affordable market. One of one of the most identified accreditations for insurance adjusters is the Affiliate in Claims (AIC) designation, offered by The Institutes, which covers click to read more necessary claim-handling concepts, policy evaluation, and lawful considerations. One more distinguished certification is the Chartered Building Casualty Underwriter (CPCU) designation, demonstrating a deep understanding of insurance products and procedures.

Verdict

Finally, independent adjusters in the insurance coverage sector can accomplish profession success by understanding the industry landscape, developing essential skills, building a solid expert network, advancing to specialized roles, and acquiring specialist certifications. By following these steps, adjusters can improve their proficiency and integrity in the field, inevitably bring about raised opportunities for development and success in their professions.

Additionally, a deep understanding of the insurance coverage sector landscape makes it possible for independent insurers to build strong relationships with insurance companies, insurance policy holders, and other stakeholders. Developing a solid specialist network and seeking mentorship from experienced insurance adjusters in the preferred specific niche can also provide open doors and valuable understandings to improvement possibilities in specialized insurer settings. By continually honing their skills and remaining abreast of market patterns, independent adjusters can place themselves for a successful profession in specialized roles within the insurance industry.

Furthermore, adjusters can go after accreditations specific to their field of interest, such as the Certified Catastrophe Threat Administration Professional (CCRMP) for disaster adjusters or the Qualified Automobile Evaluator (CAA) for car claims experts. By getting expert certifications and certifications, independent insurers can broaden their career chances and show their dedication to quality in the insurance coverage sector.